According to the Stoics (Stoicism, Stoic School), our greed and the fact that we want and try to influence things over which we have no influence, deprives us of peace of mind, as the highest goal of the Stoics.

It’s not bad to enjoy all the good things that life brings, but it’s bad to adhere to them. We can lose everything in the blink of an eye. You need to remember this and be grateful for everything. We don’t really own anything, we only use it temporarily, because everything will end and we won’t take anything with us.

Most of the time and energy needs to be invested in things that we can influence in partially. We need to invest a minimum of time in things that we can influence 100%. There is no need to invest in things we cannot influence at all.

Jevons paradox

In economics, the Jevons paradox (sometimes the Jevons effect) occurs when technological advances increase the efficiency of the use of a resource or raw material (a smaller amount is needed to ensure the same output) and this leads to higher demand for a given raw material as the price has fallen . This paradox is most common in the environmental economy. Nevertheless, country governments and environmentalists expect higher efficiency to lead to lower raw material consumption, ignoring the possibility of paradoxical development.

Dunning – Kruger Effect

The less you know, the more you think you know. Applies to people that know nothing about a certain topic, but their confidence is skyhigh. They overestimate their knowledge. This is so often visible in fb discussions, should I say disputes for example about topics like nutrition, politics, health, or delicate social stuff. On the opposite side, people with high competence tend to underestimate their knowledge and think that topic or task is simple for everyone.

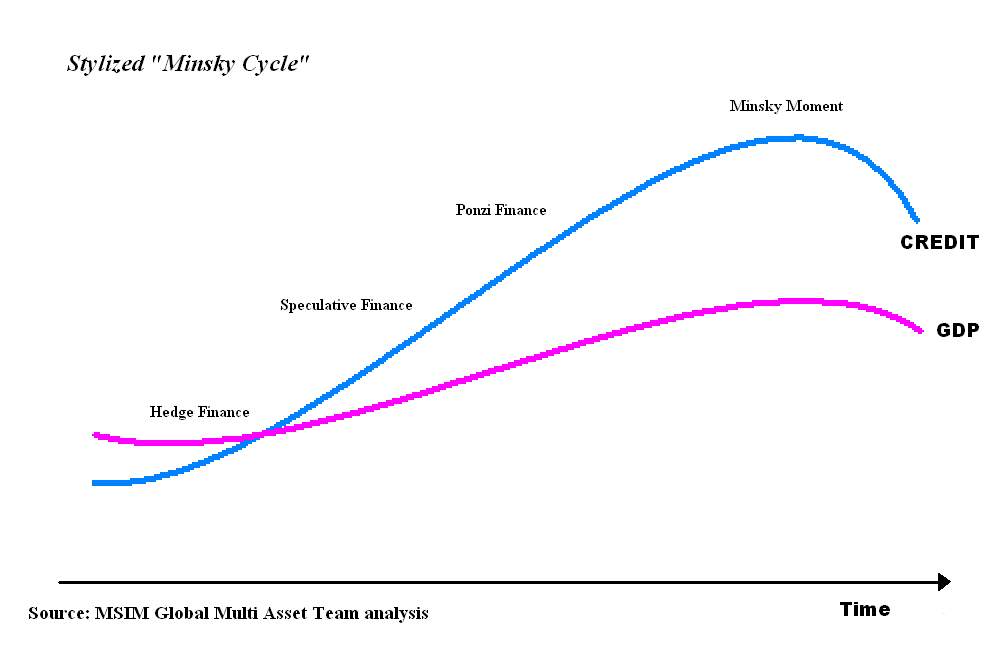

Minsky moment

A sudden moment that marks the end of the expansion, growth cycle of business activity, credit markets or stock markets. It is a major collapse of asset value.

The long and steady growth and prosperity periods lead to diminished perception of market risks. Economic subjects tend to underestimate the potential probability of economic downturn undertaking leveraged investments of borrowed money fueled by low interest rates. This speculative behavior increases prices of assets to exaggerated levels and leaves investors exposed to cash-flow crisis. As economy starts to overheat, rising interest rates increase interest payments.

Minsky cycle keeps on repeating, growth and risk-taking – leverage, decline – de-leveraging, realized losses, risk-aversion and gradual stability restoring and setting up a new cycle. This happens not only in economic activity, but also in other aspects of life.